Product Management

Friday, March 28, 2025

How to create a market analysis and avoid surprises in your product launch

According to the MIT, approximately 95% of the products launched fail to accomplish their objectives. But why this percentage? Market analysis failed? Wrong hypothesis? In this article I will explain some key points to a product launch with less stress and bumps.

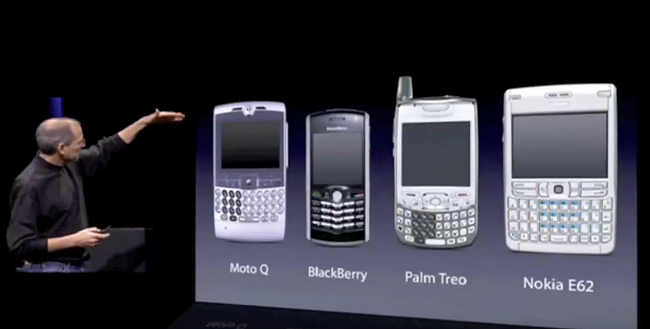

But first comes the question that I believe is crucial to launching a product: is there a market for it? One that is not taken by a competitor? Occasionally, the product you intend to launch is already in a commoditized market, which won’t bring you many earnings. Or if in this market there is a big player and your product will do the same thing. This by itself is the receipt of disaster. Below, I will list some advice to not get caught in this trap.

Market analysis

Rather than thinking about “what”, you should think about “to whom” to build your product. We should always keep in mind that our product must please the public willing to pay for it. The second key element is about the problem, to have this public paying out some money, they need to understand that as a problem in their lives to be resolved. Sometimes this issue isn’t even apparent to the public.

My last point is to differentiate your product from those already on the market. To make this validation, I will put here the Porter’s 5 force analysis, which can teach you a little bit about how you can measure your market. It is worth taking a look at the whole thesis here.

Understanding the problem

I will start by saying that in our market analysis, first you have to understand the issue that you are trying to resolve and its size. Simple issues are resolved in a predictable and clear way, which means that there is an established process to resolve them: Ex: take the car to change the oil, etc. But be careful, sometimes an established process can hide improvements, keep an eye on it.

The complex issues involve many variables: people, processes, expectations, uncertainties, competition, earnings, and losses. And it is exactly here where, in general, there are the good problems to be resolved and those that will take your product to the top of the market. How can I create an automobile that pollutes less? How can I transform the ocean’s water into something drinkable?

However, complex issues, like the name says, are complex, and it is necessary to have a better structured process map and resolve them. I will leave here another article that can help to map the problems and their root-causes, which can be used in projects and products: “How to find the root cause of your project’s problems.”

For the new product creation’s case, understanding of the issue is just the beginning. We have to verify the users that will use it, stakeholders and hypothesis search, which we will see next.

Quantitative research

I am sure that you have an initial idea of whom the users are, or even those people impacted by your new product/service. We will come back to them afterward with more details. At this point, they value starting research. The research’s objective is to collect and quantify the data about your stakeholders, understand their behaviors and tendencies, and, further on, formulate hypotheses about our problem. Normally, we create the questions as multiple-choice ones. I will mention here some examples:

- What is your monthly income?

- Until US$ 2,000

- From US$ 2,000 to US$ 5,000

- From US$ 5,000 to US$ 10,000

- Above US$ 10,0000

- What is your level of education?

- Middle school

- High school

- College

- Post-graduation / MBA

- How many properties do you have?

- Zero

- One

- Two

- 3 or more

Qualitative research

I believe that, compared to quantitative research, qualitative research is by far more important to understand who your target audience is and what they expect from our product. Here, we get their perceptions about the issue given, the reasons for its existence, and in their perspective, possible ways to resolve it. Beyond that, we capture their feelings and motivations, which can help to create a product with a bigger commercial approach. Some qualitative data could be

- Feedback

- Customer satisfaction surveys

- Interviews

- Comment on forums

- Social media analysis

Disclaimer: during your qualitative research, keep your objectives clear. It is easy to get lost in open questions, which I will explain next.

What types of questions should I do?

The first and most significant point is letting your question opened, giving the opportunity to your interviewers to put their points of view about the subject. Remember to whom we are creating our product. I have seen many managers creating products based on what they understand as good products and, in the end, being gigantic failures of sales and acceptance. The users often don't know what they want, other times they do. Keeping the balance between these two poles is crucial to creating good products. Below are some examples of good questions VS bad ones:

| Correct | Wrong | |

|---|---|---|

| 1 | What are the types of drinks you like? | Do you prefer beer or juice? |

| 2 | When was the last time you had this problem? How did you resolve it? | Have you used the X tool to resolve the issue? |

Keep in mind that we are searching for concrete user’s data, and the way we make our questions will influence how we receive our answers. Phrases like “when was the last time?” bring more concrete answers compared to “how do you do it?” by the fact that on the first, the user will give you what happened, and on the second, the user can simply answer how the process should be, instead of how the process really is.

Always be careful bringing your interviewers to the research’s objectives. After all, nobody wants to start talking about an issue regarding a lack of quality and finish talking about how hard it is to win an Olympic medal.

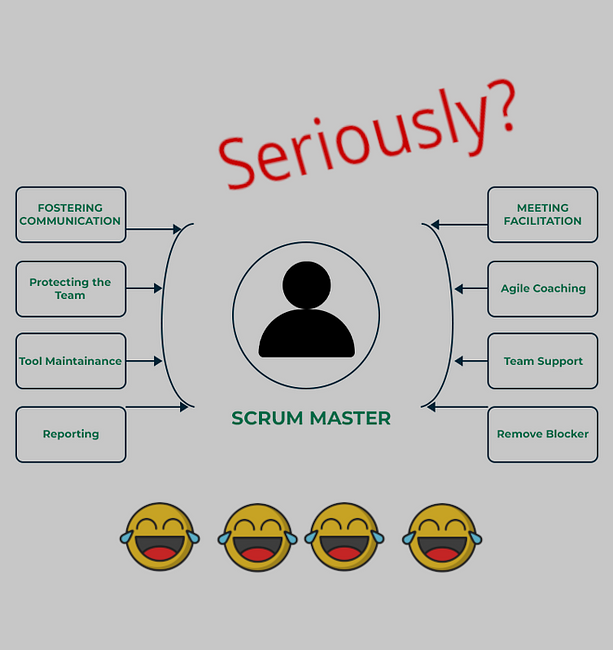

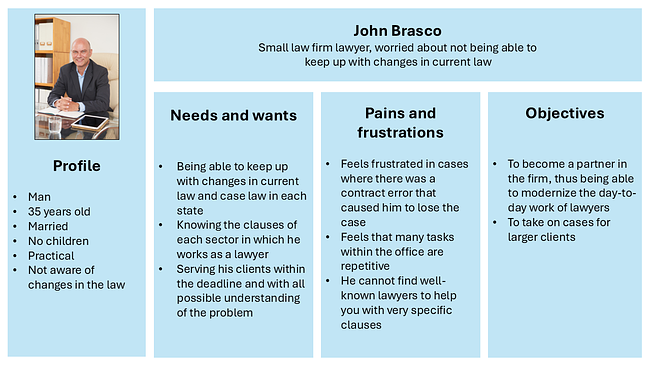

Personas

Do you remember when I commented about the personas? When we started the research to understand the market, we had an initial idea of the users and stakeholders. Here comes the moment to update our personas. But why? Because after our initial research, we have a more profound understanding of who they are and what our personas think. Many times, we discover it is not worth it to cover the necessities of some group because its impact on the product is zero. Or even discover we were focusing on the wrong people. The idea is to choose, using concrete data, which stakeholders (personas) are worth it to follow with this product and which aren’t, and their why's. In case of managing them, take a look at this article: “Stakeholders – improving your power and impact”, which can be used to create products too. I will leave an example of how we can build a persona and the information I use.

Finally, we have arrived at our hypothesis search

Hypothesis search

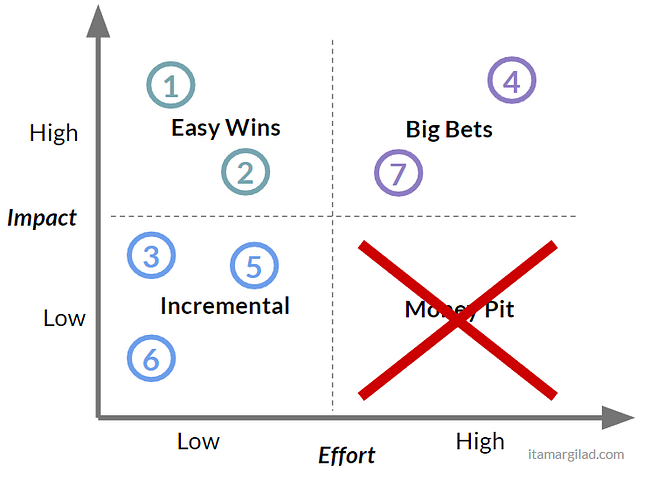

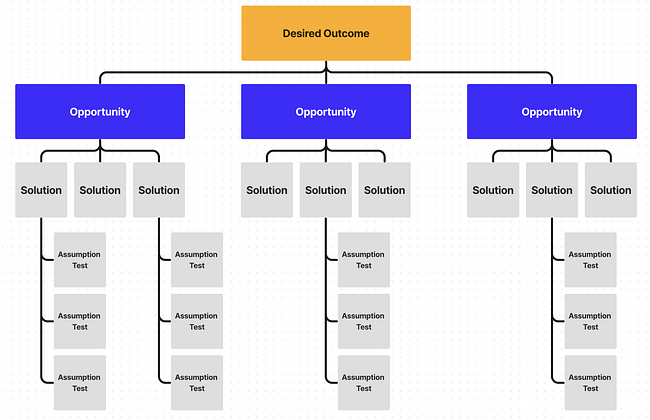

With our problem statement defined, research, and personas, we have already got a clear idea of the hypothesis (they have been defined in the middle of all processes before explained), which can solve our issue, and with these hypotheses on hand, we start our prioritization process. A disclaimer here: the less you do and the more you impact, the better it is. Because if we make a mistake or not in our choice, it is better to know upfront. You can use an impact effort solution matrix to understand which hypothesis you should test beforehand. An opportunity solution tree can help you as well. I will leave below two examples.

After the hypothesis is chosen, we start our MVP.

MVP

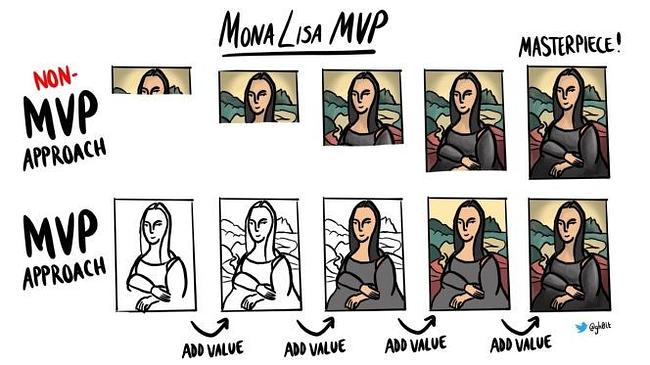

To speak about MVP, I am going to take a step backward and tell you what an MVP is not. Inside the acronym, there is a word that, many times, is forgotten: viable.

Viable means something that can be used by the users. Sometimes the understanding is: slice the product we consider like the ideal one can be called MVP. The answer is no! If the user cannot use it, it is not an MVP.

That said, my advice is to do the product with the main features, those ones that cannot remain out. Added here, to find the main features, don’t forget your personas. Imagine you are building a car:

- For the father, a large trunk

- For the 18-year-old boy, sporty face

- For the mother, back seats with more space

After creating our MVP, certify that it is being measured correctly. The bigger measuring the user, satisfaction, motivation, emotions, and interests inside your MVP, the more data you will have to improve it or throw it away and build another hypothesis.

As my last piece of advice about this subject, understand that this is a cyclical process. We start with a problem and persona, go through the research, create our hypotheses, build our MVP, test, validate, receive more data, verify the problem again, and so on…

To finalize, this is an extensive matter, with many tools being used and studied. I hope that this little resume can become a starting point and help you to have more clarity about the creation of new products. And knowing that, to be creative, processes are necessary.

I arrive at the end of this article. Here, you have learned the main steps to create a product, the study of your target market, and the key processes to not get lost in the middle of the way. And of course, no losing money or time.

Do you want to continue this talk? Would you like to add a process or tool that you use? Give a like to this article, comment on LinkedIn, or share it on your social media.

See you soon!

Erik Scaranello